The equilibrium market price is p and the equilibrium market quantity is q.

A binding price floor in the market for wheat.

Perhaps the best known example of a price floor is the minimum wage which is based on the view that someone working full time should be able to afford a basic standard of living.

The equilibrium price commonly called the market price is the price where economic forces such as supply and demand are balanced and in the absence of external.

A price floor is a government or group imposed price control or limit on how low a price can be charged for a product good commodity or service.

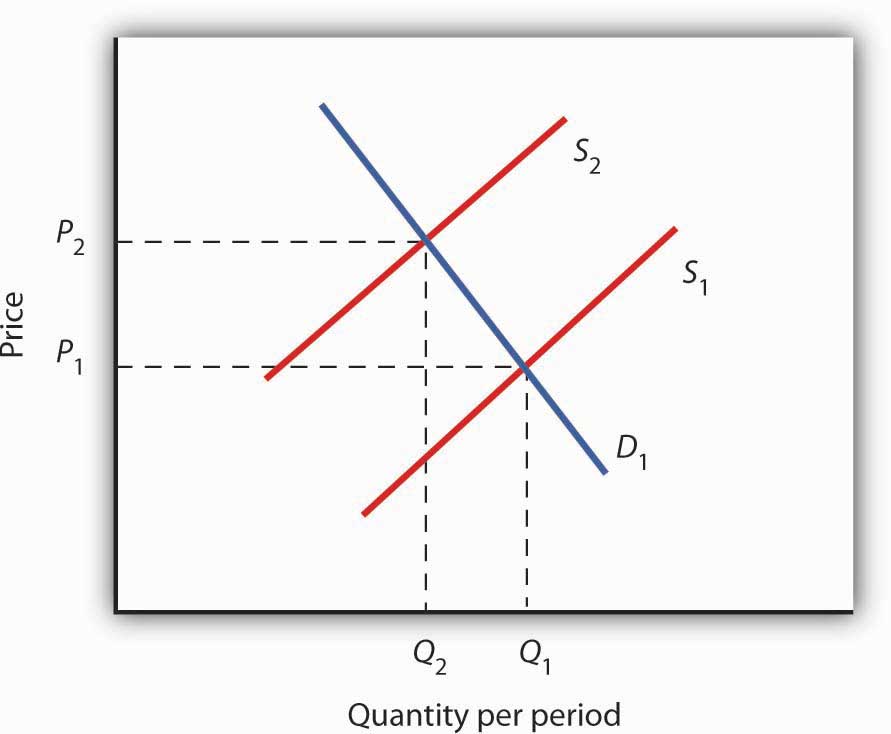

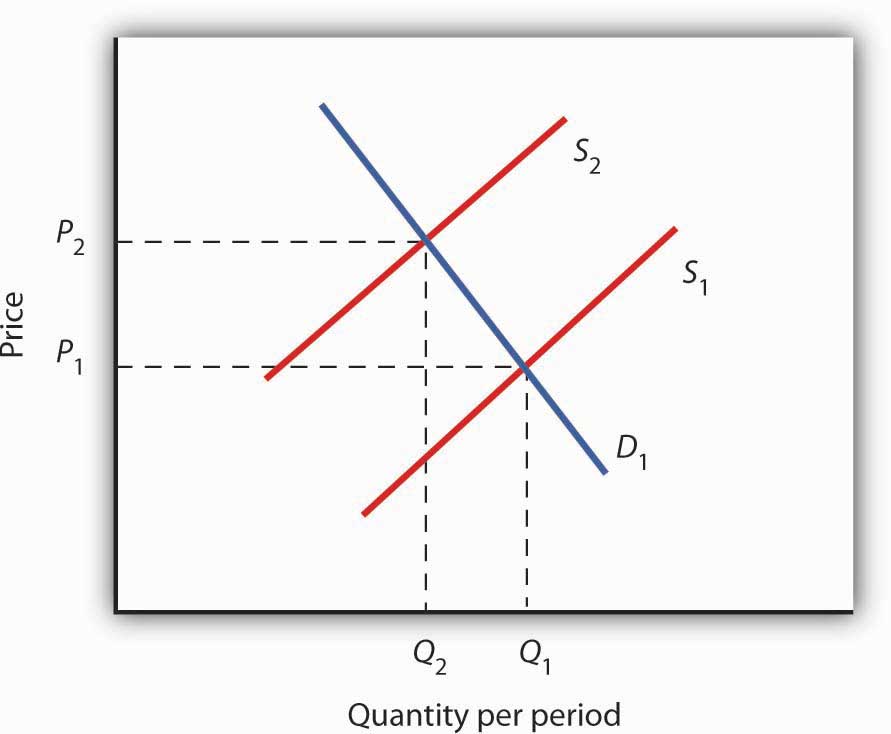

Consider the figure below.

Suppose the government sets the price of wheat at p f.

Notice that p f is above the equilibrium price of p e.

The result of the price floor is that the quantity supplied qs exceeds the quantity demanded qd.

The intersection of demand d and supply s would be at the equilibrium point e 0.

Suppose the government imposes a binding price floor in the market for wheat that is above the equilibrium price of wheat.

The result of the price floor is likely to result in.

Consumers are always worse off as a result of a binding price floor because they must pay more for a lower quantity.

A price floor or minimum price is a lower limit placed by a government or regulatory authority on the price per unit of a commodity.

A price floor must be higher than the equilibrium price in order to be effective.

A price floor is the lowest price that one can legally charge for some good or service.

A non binding price floor is one that is lower than the equilibrium market price.

However a price floor set at pf holds the price above e 0 and prevents it from falling.

There are two types of price floors.

This is a price floor that is less than the current market price.

A price floor that is set above the equilibrium price creates a surplus.